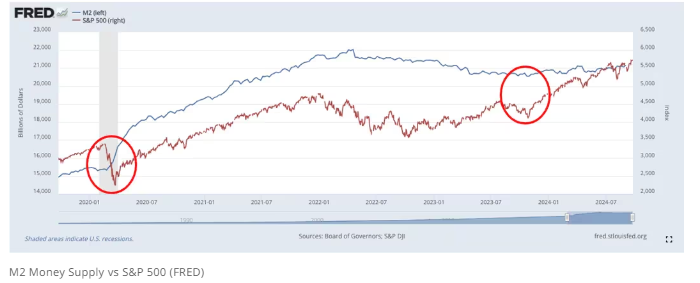

Expansionary policies by not just the Fed, but other global central banks, appear to be fueling asset price appreciation.

- In August alone, the M2 money supply rose nearly 1%, and the Fed since has trimmed interest rates 50 basis points, with what looks like another 50 basis point rate cut coming in November.

- Aggressive monetary easing by China and the U.S. Federal Reserve has driven asset price increases, with cryptocurrencies leading the charge since the recent FOMC meeting.

- The growth of the M2 money supply, with a CAGR of 7% in the past five years, has been closely linked to the performance of the S&P 500 and other assets, underscoring the critical role of liquidity in driving market performance.

FOR MORE DETAILS PLEASE CLICK HERE!